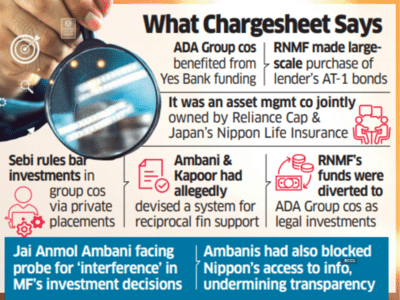

The Central Bureau of Investigation’s (CBI) chargesheet against Anil Ambani’s Reliance ADA Group and Yes Bank cofounder Rana Kapoor claims to have uncovered a carefully structured quid pro quo arrangement designed to serve their business interests and conceal financial stress through the misuse of public money.

According to the agency, funds were repeatedly disbursed, recycled, and repaid among ADA Group companies, Yes Bank, and Reliance Nippon Asset Management (RNAM) — an asset management company jointly owned at the time by Reliance Capital and Japan’s Nippon Life Insurance.

The CBI said these interlinked transactions were structured to bypass the Securities and Exchange Board of India’s (Sebi) mutual fund regulations, which prohibit investments in group or associate companies through private placements.

According to the chargesheet submitted to a special court, Ambani and Kapoor allegedly colluded to engineer a system of reciprocal financial support. While ADA Group companies benefited from large-scale funding through Yes Bank, the latter received significant investments in its capital instruments from Reliance Nippon Mutual Fund (RNMF) — effectively creating a circular flow of funds to prop up the financial health of both sides.

Investigators alleged that Ambani’s son Jai Anmol Ambani directly influenced investment decisions at RNMF even as the company was preparing to list on the stock exchanges.

Lens on Jai Anmol’s Role

According to the CBI, RNMF had access to large amounts of public money from general investors for investment in long-term debt instruments.

To overcome Sebi restrictions on investing in group companies, Ambani and Kapoor allegedly designed an arrangement that allowed RNAM’s funds to be diverted into ADA Group’s companies under the guise of legitimate investments.

As per the agency, RNMF’s large-scale purchase of Yes Bank’s AT-1 bonds and Yes Bank’s simultaneous investment in ADA Group debt papers — was a part of this arrangement. The CBI also told the court that it is probing the role of Jai Anmol Ambani.

The investigation found that Morgan Credits Pvt Ltd (MCPL), a promoter entity of the Kapoor family, issued ₹550-crore worth of non-convertible debentures (NCDs) in July 2017, approved by its board members Radha Kapoor and Roshini Kapoor. The debentures were allotted to RNMF, following a trustee agreement signed with Milestone Trusteeship.

At the same time, Yes Bank was struggling to sell ₹250 crore worth of NCDs issued by ADA Group firm Reliance Home Finance (RHFL) in December 2016, after the paper came under a credit watch. The debt investment committee of RNMF on August 3, 2017, approved the purchase of RHFL’s NCDs worth ₹249.8 crore. The two allegedly orchestrated transactions enabled funds from RNMF — raised from retail and institutional investors — to flow into MCPL, and allowed Yes Bank to offload its risky exposure to Reliance Group papers without any loss. The CBI alleged that Ambani and Kapoor met to finalise their mutual investment plans on October 6, 2017.

Soon after, Yes Bank initiated proposals to subscribe to ₹2,900-crore worth of NCDs issued by ADA Group financial companies Reliance Capital, Reliance Commercial Finance, and Reliance Home Finance. On the other hand, RNMF invested ₹1,750 crore in Yes Bank’s AT-1 bonds through private placement on October 18, 2017.

This was followed by investment of another ₹500 crore in two tranches on October 27 and December 4, 2017, taking the total exposure to ₹2,250 crore.

The CBI alleged these transactions were part of a “quid-pro-quo” with Yes Bank, providing large-scale funding to ADA Group companies in exchange for RNMF’s investments in Yes Bank’s capital instruments.

ET reviewed the chargesheet.

ADA Group did not respond to ET’s emailed queries as of press time Saturday.

According to the agency, funds were repeatedly disbursed, recycled, and repaid among ADA Group companies, Yes Bank, and Reliance Nippon Asset Management (RNAM) — an asset management company jointly owned at the time by Reliance Capital and Japan’s Nippon Life Insurance.

The CBI said these interlinked transactions were structured to bypass the Securities and Exchange Board of India’s (Sebi) mutual fund regulations, which prohibit investments in group or associate companies through private placements.

According to the chargesheet submitted to a special court, Ambani and Kapoor allegedly colluded to engineer a system of reciprocal financial support. While ADA Group companies benefited from large-scale funding through Yes Bank, the latter received significant investments in its capital instruments from Reliance Nippon Mutual Fund (RNMF) — effectively creating a circular flow of funds to prop up the financial health of both sides.

Investigators alleged that Ambani’s son Jai Anmol Ambani directly influenced investment decisions at RNMF even as the company was preparing to list on the stock exchanges.

Lens on Jai Anmol’s Role

According to the CBI, RNMF had access to large amounts of public money from general investors for investment in long-term debt instruments.

To overcome Sebi restrictions on investing in group companies, Ambani and Kapoor allegedly designed an arrangement that allowed RNAM’s funds to be diverted into ADA Group’s companies under the guise of legitimate investments.

As per the agency, RNMF’s large-scale purchase of Yes Bank’s AT-1 bonds and Yes Bank’s simultaneous investment in ADA Group debt papers — was a part of this arrangement. The CBI also told the court that it is probing the role of Jai Anmol Ambani.

The investigation found that Morgan Credits Pvt Ltd (MCPL), a promoter entity of the Kapoor family, issued ₹550-crore worth of non-convertible debentures (NCDs) in July 2017, approved by its board members Radha Kapoor and Roshini Kapoor. The debentures were allotted to RNMF, following a trustee agreement signed with Milestone Trusteeship.

At the same time, Yes Bank was struggling to sell ₹250 crore worth of NCDs issued by ADA Group firm Reliance Home Finance (RHFL) in December 2016, after the paper came under a credit watch. The debt investment committee of RNMF on August 3, 2017, approved the purchase of RHFL’s NCDs worth ₹249.8 crore. The two allegedly orchestrated transactions enabled funds from RNMF — raised from retail and institutional investors — to flow into MCPL, and allowed Yes Bank to offload its risky exposure to Reliance Group papers without any loss. The CBI alleged that Ambani and Kapoor met to finalise their mutual investment plans on October 6, 2017.

Soon after, Yes Bank initiated proposals to subscribe to ₹2,900-crore worth of NCDs issued by ADA Group financial companies Reliance Capital, Reliance Commercial Finance, and Reliance Home Finance. On the other hand, RNMF invested ₹1,750 crore in Yes Bank’s AT-1 bonds through private placement on October 18, 2017.

This was followed by investment of another ₹500 crore in two tranches on October 27 and December 4, 2017, taking the total exposure to ₹2,250 crore.

The CBI alleged these transactions were part of a “quid-pro-quo” with Yes Bank, providing large-scale funding to ADA Group companies in exchange for RNMF’s investments in Yes Bank’s capital instruments.

ET reviewed the chargesheet.

ADA Group did not respond to ET’s emailed queries as of press time Saturday.

You may also like

'Before Canada becomes new India': Social media meltdown over new turban shop in Sudbury

Russia-Ukraine war: Moscow targets power grids as US mulls supply of Tomahawk missiles; Kremlin expresses 'extreme concern'

Next shoppers say Rochelle Humes' £32 coat feels 'like being wrapped in a duvet'

Expert shares the temperature to set your heating on to help avoid mould

Roy Keane's daughter explains business she launched after incurable disease left her bed-bound