The Indian startup ecosystem continues to march upwards after the prolonged funding winter, as investors warm up to park their money in new-age tech companies even though the world grapples with geopolitical uncertainties and tariff wars.

This renewed confidence was vividly reflected in the funding numbers for the first half (H1) of 2025. Inc42’s Indian Tech Startup Funding Report H1 2025 showed that the capital raised by homegrown tech startups jumped 8% to $5.7 Bn from $5.3 Bn a year ago.

That was not all. Five startups turned unicorns in the first six months of 2025, compared to three last year and none in the same period of 2023. This was complemented by a surge in the number of mega deals valued at over $100 Mn to 11 from seven in H1 of 2024.

A growing number of venture capital (VC) and private equity (PE) firms fueled this rally with more than 1,100 investors taking part in various funding rounds in the first half of this year, shooting up 29% over the last year. This was the second straight half since H1 of 2022 when unique investor participation surpassed 1,000.

While fintech and ecommerce cornered the biggest chunk of the funds, investors also showed interest in emerging sectors like defence tech and artificial intelligence (AI).

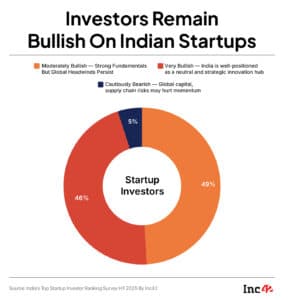

While defence tech firms, bullish on rising demand for sovereign defence technologies, hitched a ride on Operation Sindoor, a growing adoption of GenAI solutions routed the funds to AI firms. As Indian startups push the envelope, VCs and PEs turn increasingly bullish. An Inc42 investor survey found that over 95% participants were either “moderately” and ”very” bullish on Indian startups.

Meanwhile, debt funding accounted for nearly 7.6% of the total capital raised by Indian startups in H1 of 2025.

Venture debt firm Stride Ventures emerged as the most active investor, backing 47 startups, including Glance, Wow! Momo and Finnable. Alteria Capital followed closely, sealing 42 deals, and WeFounder Circle came third with 41 investments.

There was something interesting in this VC-PE play. Venture capital giants like Peak XV Partners, Accel, Z47 were nowhere on the list of top 10 investors in H1 2025.

Let’s take a look at the investors that ruled the funding turf in H1 of 2025.

Note: This ranking is based on data consolidated from Inc42’s India’s Top Startup Investor Ranking Survey [H1 2025 Edition].

| Investor Name | Type | Deal Count | Notable Investments |

| Stride Ventures | Venture Debt Firm | 47 | Glance, Park+ Wow Momo, Finnable, Moxie Beauty |

| Alteria Capital | Venture Capital Firm, Venture Debt Firm | 42 | Giva, Apnamart, Euler Motors, Moneyview, Vegrow |

| We Founder Circle | Angel Network | 41 | Hedged, Pickkup, Growit, Machaxi, Awnest, Tarzanway |

| ah! Ventures Fund | Venture Capital Firm, Angel Network | 35 |

SnapE Cabs, TechMonk, Snackible, Saleagent AI, SuperBottoms, Getmycruise |

| Rainmatter Investments | Corporate Venture Capital | 34 |

Solarsquare, Game Theory, Ossus Biorenewables, Fittr, Amwoodo, Pensionbox, SuperYou |

| Blume Ventures | Venture Capital Firm | 31 | GoStops, TakeMe2Space, GreyOrange Robotics |

| IAN Group | Venture Capital Firm | 20 | brainsight, serigen, fluxgen, innovidgm, famyo |

| InnoVen Capital | Venture Debt Firm | 20 | Ather, Zetwerk, Euler, Captain Fresh, Univest |

| India Accelerator | Accelerator | 19 | Great, Battwheelz, SaleAssist, Paramount, IIndepro |

| Accel | Venture Capital Firm | 19 | Presentations.AI, Sarla Aviation, Scimplifi |

| Inflection Point Ventures | Venture Capital Firm | 19 | BrainSightAI, GreenStitch.io |

| Blacksoil | Venture Debt Firm | 19 | Chalo, epay, letstransport, Celcius Logistics, Red Health |

| Trifecta Capital | Venture Debt Firm | 18 | Farmart, Spintly, Magenta Mobility, Karkhana |

| 3one4 Capital | Venture Capital Firm | 17 | Rezolv, Felicity, Fermbox |

| Swadharma Source Ventures | Venture Capital Firm | 16 | Troovy, Eight Network, Mugafi, Thermoflyde |

| Antler India | Venture Capital Firm | 16 | Navana, Green Aero, Armory, Hify, Wellopia |

| Venture Catalysts | Accelerator | 15 | Almonds Ai, ParkMate, Stage |

| Finvolve Fund | Venture Capital Firm | 15 | Droom, Indrajaal, PerniaPop, Rohal, Tummoc |

| RTP Global | Venture Capital Firm | 15 | Flam,CRED,GoKwik,StableMoney |

| Titan Capital | Venture Capital Firm | 15 | Contravault AI, Be Clinical, Revspot, FlickTv, Anveshan, Tyreplex |

| All In Capital | Venture Capital Firm | 14 | Defendron, Arctan AI, Krvvy, Nprep, Moms made |

| FAAD Network Private Limited | Angel Network | 13 | Sumosave, Bluwheelz, H2CO, JustDeliveries, Burma Burma |

| Huddle Ventures | Venture Capital Firm | 13 | True Diamond, Asaya, Green Grahi, Rumik |

| Zeropearl VC | Venture Capital Firm | 12 | Gully Labs, Cura Care, Catalogus, Tryo, Steampro |

| 100Unicorns | Venture Capital Firm | 12 | Lets Try, Carepal, Optimized Electrotech, Alchemyst AI |

| Ivycap ventures advisors Pvt Ltd | Venture Capital Firm | 11 | BrainSightAI, GreenStitch.io |

| 2am VC | Venture Capital Firm | 10 | Apna Mart, Florzy, Linkrunnr, Jumbo, Flent |

| Peak XV Partners | Venture Capital Firm | 10 | Atomicwork, Eduvanz, The Whole Truth |

| Z47 | Venture Capital Firm | 10 | Foxtale, SuperOps, The Whole Truth |

| Veltis Capital | Venture Capital Firm | 9 | Troovy, Intellithink, My Designation, NOOE, Legend of Toys |

| DeVC | Venture Capital Firm | 9 | Ambak, Boba Bhai, Felicity Games |

| British International Investment | Public Institution | 8 | FlexiLoans, Euler Motors, Grow Indigo, CureBay |

| Eximius Ventures | Venture Capital Firm | 8 | Amicco, DevAssure, DecoverAI, AstroCulture & Triple Tap Games |

| OTP Ventures | Venture Capital Firm | 8 | Plush, Asaya, CirclePe, LifeGuru, Zeelabs, Hoop, GetPhab |

| SucSEED Indovation Fund | Venture Capital Firm | 8 | DaveAI, SitePace.ai, Beat22, IndiLabs, We360.ai |

| Piper Serica Angel Fund | Venture Capital Firm | 8 | Rupeeflo, Astrogate, Continue.ai, OTPless, KIVI |

| AC Ventures | Venture Capital Firm | 8 | Open Secret, Minus Zero, Phot.AI |

| Gemba Capital | Venture Capital Firm | 8 | Flick TV, Pazy, Navadhan Capital |

| ITI Growth Opportunities Fund | Venture Capital Firm | 7 | Reelsaga, Hexa Health, MPC, Grip Invest, Fasal |

| Unicorn India Ventures | Venture Capital Firm | 7 | Pe Local, Netrasemi, Stampmyvisa, Aurasure, Piscium |

| Sauce.vc | Venture Capital Firm | 7 | Loopie, Sammmm, Metashot, UniSeoul, Cove and Lane, |

| India Quotient | Venture Capital Firm | 7 | True Diamond, Bizup, Home Essentials, Khidki Homes |

| Gruhas | Venture Capital Firm | 7 | Bold Care, Broadway, Dreamtime Learning |

| DSG Consumer Partners | Venture Capital Firm | 7 | Rabitat, Farmley, Anveshan, StayVista |

| YourNest Capital Advisors | Venture Capital Firm | 6 | Perkant Tech, Presage, MapMyCrop, ThinkMetal, CargoFL |

| Riceberg Ventures | Venture Capital Firm | 6 | Akashlabdi, KosmosOne, Cligent, AnduraX |

| AdvantEdge Founders | Venture Capital Firm | 6 | Zeno, Cotodel, Grip |

| VentureSoul Partners | Venture Debt Firm | 6 | Captain Fresh, Metro Telworks, True Credits, Zolostays, Metalbook |

| Aarii Ventures | Family Office | 5 | Eume, Homeville, Creditwise, PMI Electro, Shreetech |

| Arali ventures | Venture Capital Firm | 5 | Jidoka, Quash, Pibit, Fluxgen, Bidaal |

| SenseAI Ventures | Venture Capital Firm | 5 | Contineu.ai, Irame.ai, Sherlocks.ai, CodeKarma,Pipeshift.ai |

| Sun Icon Ventures | Venture Capital Firm | 5 | Dreamfly innovation, GrowIt |

| Capria Ventures | Venture Capital Firm | 5 | Magma, BetterPlace, BharatAgri, Blowhorn, Gigforce |

| TDV Partners | Venture Capital Firm | 5 | Hypergro, SportsforLife, QuantE |

| Lightspeed Venture Partners | Venture Capital Firm | 5 | Snabbit, Data Sutram, Udaan, Whizzo |

| Prime Venture Partners | Venture Capital Firm | 5 | Frinks AI, Metafin, Bolt.Earth, Gallabox |

| Source: Inc42 | |||

This sector-agnostic venture debt firm topped the chart, backing 47 startups like Glance, Wow! Momo and Finnable. This was more or less in line with the 70 cheques it wrote for Indian startups in the whole of 2024.

Since its inception in 2019, the investment firm has backed over 150 startups, including Zepto, SUGAR Cosmetics, Ather, and BlueStone. It majorly supports growth-stage startups across sectors like agritech, B2B ecommerce, cleantech, edtech, fintech, SaaS, and healthcare.

Stride closed its $154 Mn Fund III in May 2024 and followed it up by announcing its largest fund yet – the $300 Mn Fund IV in December 2024. A month later, Stride said that it was partnering with DPIIT to offer funding, mentorship, and market access to budding Indian startups, with a focus on sectors such as manufacturing, consumer goods, B2B, and cleantech.

Alteria CapitalAlteria Capital secured second spot on the list of active investors with 42 investments in the first half of 2025. Some of its major investments included GIVA, Apna Mart, Euler Motors, Moneyview, Vegrow, Pratilipi and WayCool.

Founded in 2017 by Ajay Hattangdi and Vinod Murali, Alteria primarily invests in Indian startups that have already secured significant equity funding. The fund claims to have backed more than 200 startups and invested over $750 Mn.

With more than 15 unicorns in its kitty, the venture debt firm’s portfolio includes startups such as BharatPe, Bombay Shaving Company, Cars24, DailyHunt and Jupiter. It claims to manage assets under management (AUM) worth $550 Mn.

We Founder CircleVC firm We Founder Circle made 41 investments in startups like Hedged, Pickkup, Growit, Machaxi, Awnest and Tarzanway.

Founded in 2020 by Neeraj Tyagi, Gaurav VK Singhvi, Bhawna Bhatnagar, and Vikas Aggarwal, We Founder Circle claims to be a community-based investment platform with members including corporate executives, founders, and investors, who have been part of both domestic and global startup ecosystems.

We Founder Circle dishes out cheques in the range of $300,000 to $1 Mn. The firm follows a sector-agnostic approach and has invested in more than 150 startups to date.

ah! VenturesAt the fourth spot on the active investor chart is ah! Ventures. During the first six months of 2025, the investment firm backed 35 startups such as SnapE Cabs, TechMonk, Snackible, Saleagent AI, SuperBottoms, and Getmycruise

Founded in 2009 by Harshad Lahoti and Abhijeet Kumar, ah! Ventures claims to be a “fundraising platform” for early-stage startups. The investment firm typically infuses $100,000 to $1 Mn through its First Gear and Angel Platforms, and up to $10 Mn through its High Tables Platform.

The fund claims to have made over 239 investments to date, infusing more than $56 Mn from its various platforms. It also counts names such as Zealopia, TechMonk, Agrilectric, Markytics, Exotel, Settl and SuperBottoms in its portfolio.

Rainmatter By ZerodhaRainmatter By Zerodha clocked 34 investments in the first half of this calendar year. These include names such as Solarsquare, Game Theory, Ossus Biorenewables, Fittr, Amwoodo, Pensionbox and SuperYou.

Established by Zerodha in 2016, Rainmatter functions as the VC arm of the invest tech giant, making investments with a long-term perspective and without strict exit mandates. The firm primarily backs early-stage startups in sectors such as fintech, health and wellness, climate tech, and storytelling.

It also provides mentorship, networking and access to Zerodha’s APIs to portfolio companies. The VC has made more than 146 investments to date, backing notable names like CRED, smallcase, Ultrahuman, Jupiter, among others.

Blume VenturesVC firm Blume Ventures ranked sixth on the list of top Indian investors in H1 2025 by cracking 31 deals. It invested in startups like PowerUp Money, Atomicwork, Swish Club, GoStops and TakeMe2Space.

Founded in 2010 by Karthik Reddy and Salnjay Nath, the VC firm primarily backs seed or Pre-Series A startups. Blume Ventures invests $1 Mn to $5 Mn. Its investment portfolio includes Unacademy, Spinny, Slice and Spinny. The VC firm has four investment vehicles and has an AUM of $600 Mn.

InnoVen CapitalWith 20 investments, venture debt firm InnoVen Capital grabbed the seventh spot on the list of most active Indian investors in H1 of 2025.

Ashish Sharma-founded InnoVen Capital provides debt to early stage and growth stage startups. Since its birth in 2008, it has invested more than $800 Mn in more than 200 startups.

The investor has 35 unicorns in its portfolio, including Udaan, Spinny, Jumbotail, Swiggy, Curefit, BharatPe and BlueStone. It plans to invest INR 100 Cr in fintech soonicorn Lendingkart.

Indian Angel NetworkSeed and early-stage startup investment platform IAN featured at the eighth spot on the list closing 20 deals in the first six months of this year. It backed startups like Pepper Mint Robotics, BrainSightAI and Astrome Technologies.

Founded in 2006, IAN boasts of a network of more than 500 angel investors that are primarily entrepreneurs and CEOs. The network has so far invested INR 900 Cr in more than 220 companies through two funds – IAN Fund I and IAN Alpha Fund – and counts four unicorns in its kitty, including Spinny, Ola, Druva and Uniphore.

India AcceleratorDelhi NCR-based India Accelerator (IA) made 19 bets in H1 of 2025, ranking ninth on the list of the most active investors in this period. Its notable bets include Grest, Rohal Technologies and Droom.

The Ashish Bhatia-led VC firm invests in multi-stage startups in India and the UAE. Founded in 2017, it runs short-term accelerator programmes focussed on fintech, AI, cybersecurity, health, and agritech to provide funding, training and mentoring. It also has an accelerator programme, especially for defence tech startups, called Advait.

India Accelerator has more than 200 startups in its portfolio and is running four active funds. It has so far invested in companies like Hippo, Clean Motion, Zulu, and SunFo.

BlackSoilVenture debt firm BlackSoil made 19 deals in H1 of 2025, backing startups like Celcius Logistics and Epaylate.

Founded in 2010 by father-son duo of Mohinder Pal Bansal and Ankur Bansal, BlackSoil is an alternate investment platform that provides credit solutions to startups and invests in new economy businesses.

It offers innovative debt solutions, including venture debt and structured debt, to startups. The firm also runs an NBFC, called BlackSoil Capital, to provide loans to SMEs and high-growth companies. It also owns SaralSCF, which provides working capital to enterprises.

BlackSoil counts the likes of OYO, Spinny and WebEngage as part of its portfolio. In April, the Reserve Bank of India gave its nod to the merger of BlackSoil Capital with impact investment lender Caspian Debt.

The post Meet 10 Most Active Startup Investors Of H1 2025 appeared first on Inc42 Media.

You may also like

Bihar law and order in question: A lawyer shot in Patna; series of killings sparks outrage against Nitish govt

Tamil Nadu: Three boys drown while bathing in pond

Carlos Alcaraz's astonishing net worth as he pockets millions in prize money aged 22

Southend Airport plane crash: Full list of cancelled easyJet flights

'Gripping' crime thriller has 'Tom Hardy's best on screen performance in years'