When MobiKwik listed last December, it was at the tail end of a cycle for startup IPOs that has not yet revived. Nevertheless, it was seen as a coming of age for the Delhi NCR-based fintech company.

Six months later though, some of the statements saying that MobiKwik has matured could be labelled as overenthusiastic. If anything, MobiKwik’s problems mirror that of Paytm in 2024, and after its Q4 results, the company finds itself deeper in the red.

MobiKwik reported a net loss of INR 121.53 Cr for the full year (FY25) as against a net profit of INR 14.1 Cr in the previous year. Naturally, there were a lot of questions from analysts and observers in the wake of the weak results and generally poor quarter from the bottom line perspective.

Can MobiKwik answer them all? Before we find out, a look at the top stories from our newsroom this week:

- As GLP-1 medications make their way into India, Bengaluru-based Healthify has turned to Mounjaro for its all-new weight loss programme, backed by nutrition, physical training, and lifestyle changes

- Despite repeated crackdown on similar platforms for obscenity, Ullu has stayed online with its user base multiplying and revenue surging over the years. Here’s how the adults-only platform has kept going

- The multilayered ecommerce platform fees and advertising spends have become a major concern for D2C brands and ecommerce sellers, who bemoan shrinking margins and byzantine fee structures

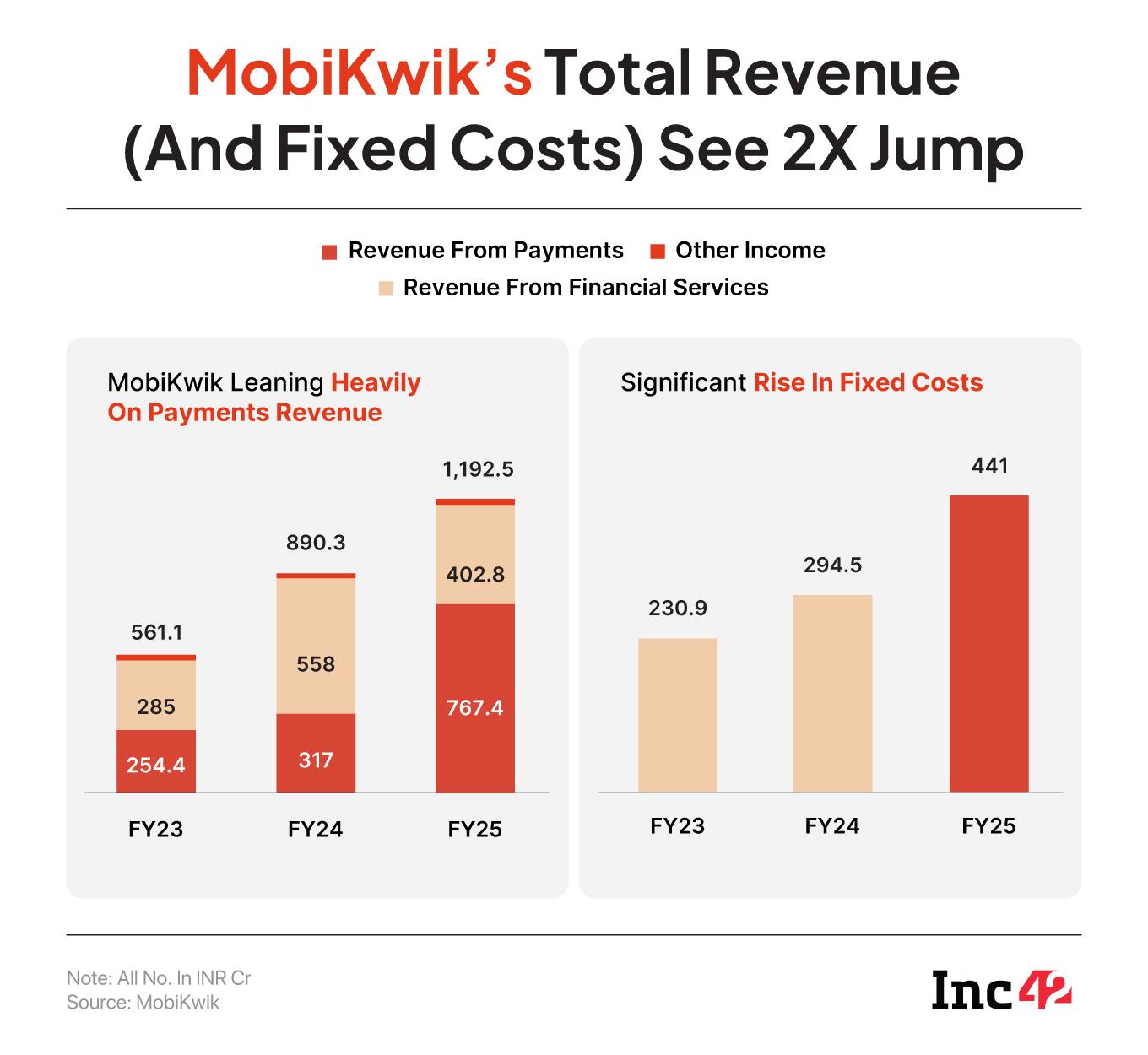

Despite the higher losses, the company’s revenue growth of 33.7% to INR 1,170.2 Cr from INR 875 Cr in FY24 is being seen as a bright sign. The increase in loss was primarily due to the low contribution margin of the company’s lending vertical which weighed down the overall revenue growth.

MobiKwik’s financial services vertical, which includes lending, insurance, bill payments, mutual funds, and DTH recharge businesses, was badly hit. Segment revenue dipped to INR 56.2 Cr in Q4 FY25 from INR 73 Cr in the preceding quarter, marking the second consecutive quarter of decline.

With regards to its lending business, MobiKwik said the vertical was impacted due to macro and accounting changes during the quarter.

In its earnings call, MobiKwik CFO Upasana Taku said that the lending business’ transition to a default loss guarantee (DLG) model, which it began after September 2024 means the company has to allocate a portion of the expected credit loss upfront. And revenue from DLG-attached loans is recognised over time.

This, the company said, impacted its bottom line, and it expects the situation to stabilise in the next 2-3 quarters.

“We do feel that over the next few quarters we will get towards that… gross margin, which was 40%… last year…” Taku said.

Going ahead, the company’s plan centres on strengthening its core payments business, recalibrating its lending operations, and developing its ZaakPay payment gateway, alongside a focus on cost efficiency, cofounder and CEO Bipin Preet Singh told analysts this week.

Can MobiKwik Tap The Power Of UPI?A silver lining for the fintech company was the continued growth in its payments GMV, which zoomed 12.2% QoQ to INR 33,066 Cr in Q4 FY25. MobiKwik said that its payments revenue grew 23.9% sequentially to INR 211.6 Cr in the quarter under review.

MobiKwik expects its payments revenue to rise further on the back of its launch of Pocket UPI, which allows users to make UPI payments directly from MobiKwik’s digital wallet. The company believes Pocket UPI has a user retention potential and the product’s utility in allowing UPI transactions without direct bank account linkage is attractive for younger and older Indians, who may be wary of fraudulent activities in online payments.

This is enabled through the MobiKwik wallet and wallet-to-UPI transactions have a 1.1% merchant discount rate or commission attached, but this is only for transactions above INR 2,000.

The company is also banking on MDR on UPI transactions, which would provide an additional revenue stream, with the company indicating that a “decent double-digit percentage” of its GMV could draw an MDR benefit based on the transaction size.

However, it also must be noted that MobiKwik is a significantly smaller player compared to UPI apps that have only launched recently such as Navi or Super.Money.

In April 2025, for instance, MobiKwik registered just 3.17 Cr UPI transactions, compared to 6.74 Cr for WhatsApp, and close to 10 Cr for FamApp. Flipkart-owned Super.Money had 17.5 Cr transactions, while Navi had 10X the volume that MobiKwik recorded with 35 Cr transactions.

These numbers do not paint MobiKwik in a positive light. The reason why many of these UPI apps have risen up the rankings is largely due to spending on customer acquisition. It would be hard for MobiKwik to turn a profit consistently on the back of such a smaller user base in a market where cumulatively 1,800 Cr transactions were recorded in April. MobiKwik’s share is miniscule in this market.

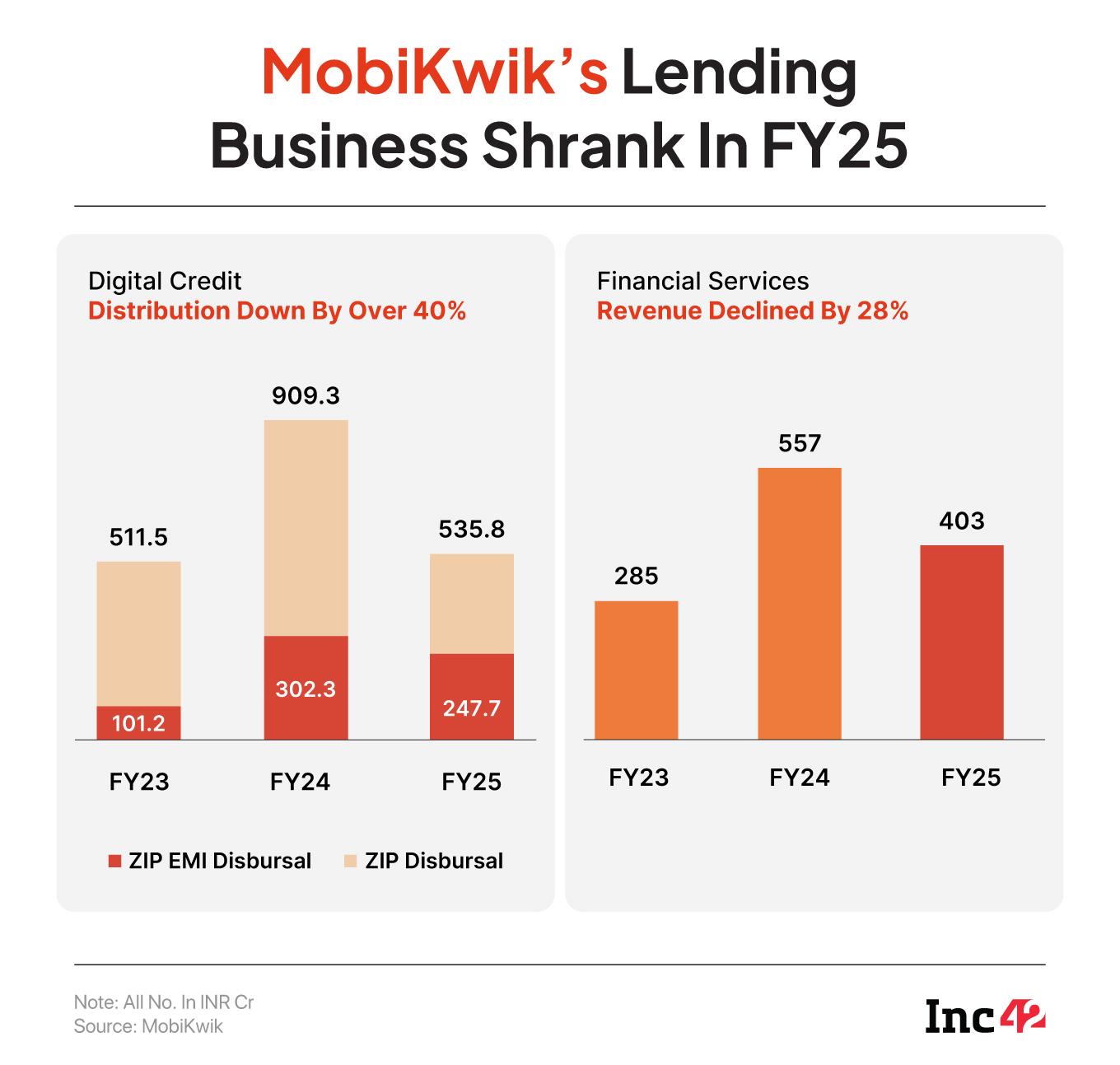

What About Loans?After the RBI’s crackdown on the froth in the digital lending market over the past two years, and stringent rules on lenders (both platforms and banks), most fintech players have had to recalibrate their approach.

MobiKwik’s lending business has encountered challenges due to regulatory changes, which have affected its short-term performance and contribution margins. The company said it is discontinuing its shorter-duration BNPL product and is now focusing on the ZIP EMI offering for personal loans. The GMV for ZIP EMI grew 32% quarter-on-quarter in Q4 FY25, Singh added.

Its strategy is also geared towards less risky lending such as secured loans, loans against mutual funds, and promoting RuPay credit card, which has a 30-day credit facility and offers an upselling pathway to longer-duration loan products.

With revenue recognition being deferred due to DLG, MobiKwik claims that contribution margins from lending are temporarily impacted. It anticipates a recovery in the second half of FY26. Singh said the objective is to return the lending business to a portfolio-level contribution margin of approximately 40%, with a net take rate (after DLG and credit costs) of around 4%-4.5%.

The other part of the loan equation is merchant lending, where MobiKwik will be deploying more soundboxes for payments with small merchants in the hope of bringing them on as borrowers. The strategy mirrors Paytm, PhonePe, CRED, BharatPe and many others that have occupied niches within the merchant ecosystem, and breaking into this would not be easy or cheap.

The Third Pillar: Payment AggregatorThe final piece of MobiKwik’s future plan is ZaakPay, the company’s payment gateway subsidiary which has received the RBI approval for full payment aggregator and payment gateway license.

MobiKwik management said ZaakPay has been historically under-invested and there were licensing uncertainties, which have now been cleared. But MobiKwik’s past track record does not indicate that it has the wherewithal to compete with Razorpay, Cashfree, BillDesk, PayU, JusPay, CCAvenue and a host of other companies that have boarded the payment aggregator

“ZaakPay is extremely small right now compared to the industry leaders, but it also means that there is a significant opportunity for us to unlock value. By focusing and selecting the right use cases, the right set of merchants and the right set of partnerships that we are very confident of building, to build a sizeable business which will start contributing not just to the GMV but also to the profitability of the overall business,” CEO Singh told analysts.

The language suggests that ZaakPay is starting from scratch, and competing against established giants with playbooks for merchant acquisitions will take significantly more investment and time than perhaps MobiKwik is giving credit for.

Among the three pillars that MobiKwik is relying on, the lending vertical is perhaps the most important one for the company, as it allows the other two verticals the time to grow and turn profitable. It will be critical that MobiKwik is able to onboard creditworthy borrowers through its partners and its co-branded credit card partnership.

Moreover, in the past few months, MobiKwik has taken the super app model seriously with the launch of investment tech and insurance products. Will this come into play next quarter?

Now that it’s a publicly listed company, MobiKwik has to accelerate the timeline to scale up these key verticals. The stock is down 63% since late December, and every quarter that does not bring improvement will be another where the stock market punishes the scrip.

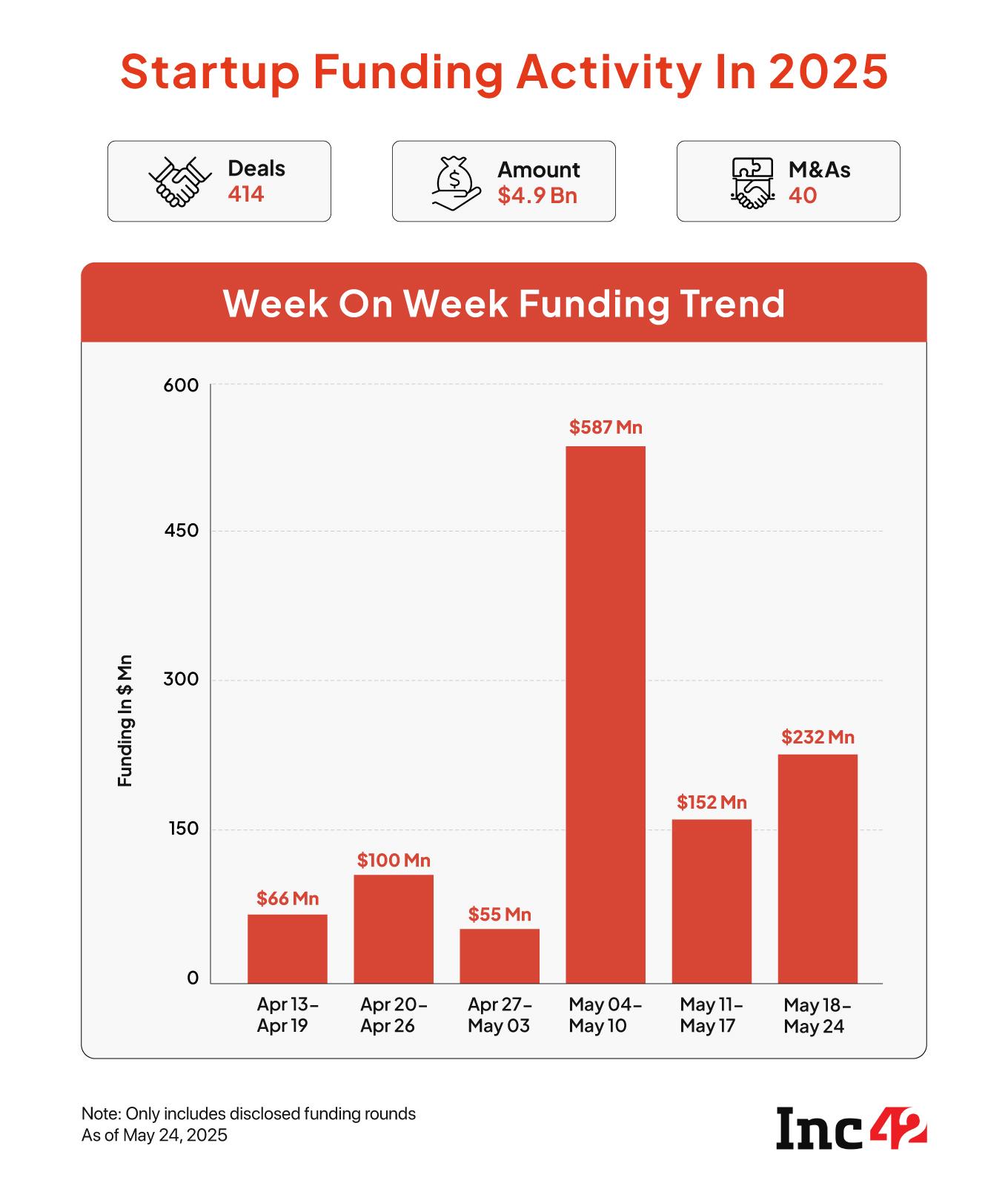

Sunday Roundup: Startup Funding, Deals & More- : With big rounds taking the spotlight this week, startups cumulatively bagged $232 Mn across 16 deals between May 19 and 24, taking the tally for the year close to $5 Bn

- Quick delivery major Zepto’s quick food delivery arm Zepto has temporarily shut operations in multiple small cities, mostly in north India, like Agra, Chandigarh, Meerut, Mohali and Amritsar.

- Taking another shot at Apple’s manufacturing plans for India, US president Donald Trump has said that Apple would have to pay at least 25% tariff on iPhones manufactured outside the US

- Weeks after the Microsoft-backed company admitted “problems” under its past leadership, Builder.AI is now reportedly commenced insolvency proceedings

- Delhi NCR-based Otipy has pulled the curtains on its farm-to-table operations, leaving around 300 employees in the lurch, according to sources

The post appeared first on .